japan corporate tax rate kpmg

Aug 31 2021. Japan 34 42 42 Korea Republic of 297 297 35 36 Luxembourg 3038 3038 Malay 37 sia 28 28 Mexico 38 34 33.

Presented By Ayesha Macpherson Tax Partner Kpmg Hong Kong Making The Best Tax Decisions For Your China Business Ventures March Ppt Download

Size-based business tax consists of two components.

. In 2021 the highest tax rate in Japan was 5597 percent. The current consumption tax rate is 10 percent increased from 8 percent on 1 October 2019. Tax rates tool test page.

KPMG Tax Corporation either through your normal contact at the firm or using the contact details shown below. Statutory Corporate Income Tax Rate in Japan as of April 2014 1. 81 6 4706 3881 Dainagoya Building 26F 3-28-12 Meieki Nakamura-ku.

Corporate inhabitants tax - Prefectural standard 4 08 13 13. The regular business tax rates vary between 03 and 14 depending on the tax base taxable income and the location of the taxpayer. Data is also available for.

Corporate Marginal Tax Rates - By country. 81 3 5575 0766 E-mail. Insights Industries Services Events Careers About us KPMG Personalization Get the latest KPMG thought leadership directly to your individual personalized dashboard.

Contact KPMGs Federal Tax Legislative and Regulatory Services Group at 1 2025334366 1801 K Street NW Washington. Principal International Tax KPMG US. From 072 percent to 0864 percent.

Size-based business tax consists of two components. Donations and the corporate income tax rates are the same for both a branch and a Japanese company. Kpmgs corporate tax rates table provides a view of corporate tax rates around the world.

The survey begun in 1993 currently covers 69 countries. KPMG in Japan T. Get in touch with us now.

Share with your friends. The statistic shows the highest tax rate in Japan from 2011 to 2021. Corporate and international tax proposals in tax reform package 19 December 2018.

81 3 6229 8000 Fax. Special local corporate tax rate is 1526 percent which is imposed on taxable income multiplied by the standard of regular business tax rate. The special local corporate tax rate is 4142 and is imposed on taxable income multiplied by the standard regular business tax rate.

KPMGs corporate tax rates table provides a view of corporate tax rates around the world. Taxable income 4 mln 8 mln 4 mln 8 mln. Kpmg KPMGs Corporate Tax Rates Survey January 2004 KPMGs International Tax and Legal Center is pleased to present its annual survey of corporate tax rates.

2021 Global Withholding Taxes. Central government tax 3 190 255 255. However a branch and a.

Corporate tax rate in japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of. Corporate Tax Rate Survey 20064. I added value component tax rate.

Detailed description of taxes on corporate income in Japan National local corporate tax. Corporate income tax. Local management is not required.

Special local corporate tax rate is 935 percent which is imposed on taxable income multiplied by the standard of regular business tax rate. KPMG Tax Corporation either through your normal contact at the firm or using the contact details shown below. KPMGs corporate tax table provides a view of corporate tax rates around the world.

81 3 5575 0766. 81 6 4708 5150 Fax. Download as an excel file instead.

KPMG Tax Corporation Izumi Garden Tower 1-6-1 Roppongi Minato-ku Tokyo 106-6012 Japan Tel. 22 to 28 depending on the companys shareholders structure corporate structure and disclosure compliance. Rates Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes Residence A company that has its principal or main office in Japan is considered to be resident.

81 3 6229 8000 Fax. I added value component tax rate. Beginning from 1 October 2019 corporate taxpayers are required to file and pay the national local corporate tax at a fixed rate of 103 of their corporate tax liabilities.

From 048 percent to 0576 percent. KPMG Tax Corporation Izumi Garden Tower 1-6-1 Roppongi Minato-ku Tokyo 106-6012 Japan Tel. Size-based business tax consists of two components.

Japan 4069 4069 40 Jamaica 333 333 41 Kazakhstan 30 30 42 Korea Republic of 275 275 43 OECD European Union Asia - Pacific Latin America. Summary of worldwide taxation of income and gains derived from listed securities from 123 markets as of December 31 2021. Special local corporate tax rate is 674 percent which is imposed on taxable income multiplied by the standard of regular business tax rate.

Historical corporate tax rate data. 81 3 6229 8070 E. Changes to the controlled foreign corporation CFC regime considering the corporate tax rate reduction in the United States.

A reduced tax rate of 8 percent still applies to certain supplies see further explained below. Regular business tax rates currently apply and vary between 09 percent and 228 percent depending on the tax base taxable income and the location of the taxpayer. Indirect tax rates individual income tax rates employer social security rates and employee social security rates and you can try our interactive tax rates tool to compare tax rates by.

KPMGs Corporate Tax Rates Survey January 2006 Region Average statutory rate EU 2504 Asia Pacific 2999 Latin America 2825.

Minimum Global Corporate Tax Rate Gains Support Kpmg Canada

Taxation In Japan 2019 Kpmg Japan

Outline Of The 2022 Tax Reform Proposals Kpmg Japan

Net Zero Readiness Index Japan Kpmg Global

Kpmg Corporate Tax Manager Kpmg Romania

5 General Business Tax Issues Treasury Gov Au

Presented By Ayesha Macpherson Tax Partner Kpmg Hong Kong Making The Best Tax Decisions For Your China Business Ventures March Ppt Download

Outline Of The 2021 Tax Reform Proposals Kpmg Japan

Net Zero Readiness Index Japan Kpmg Global

World S Highest Effective Personal Tax Rates

Minimum Global Corporate Tax Rate Gains Support Kpmg Canada

![]()

Canadian Personal Tax Tables Kpmg Canada

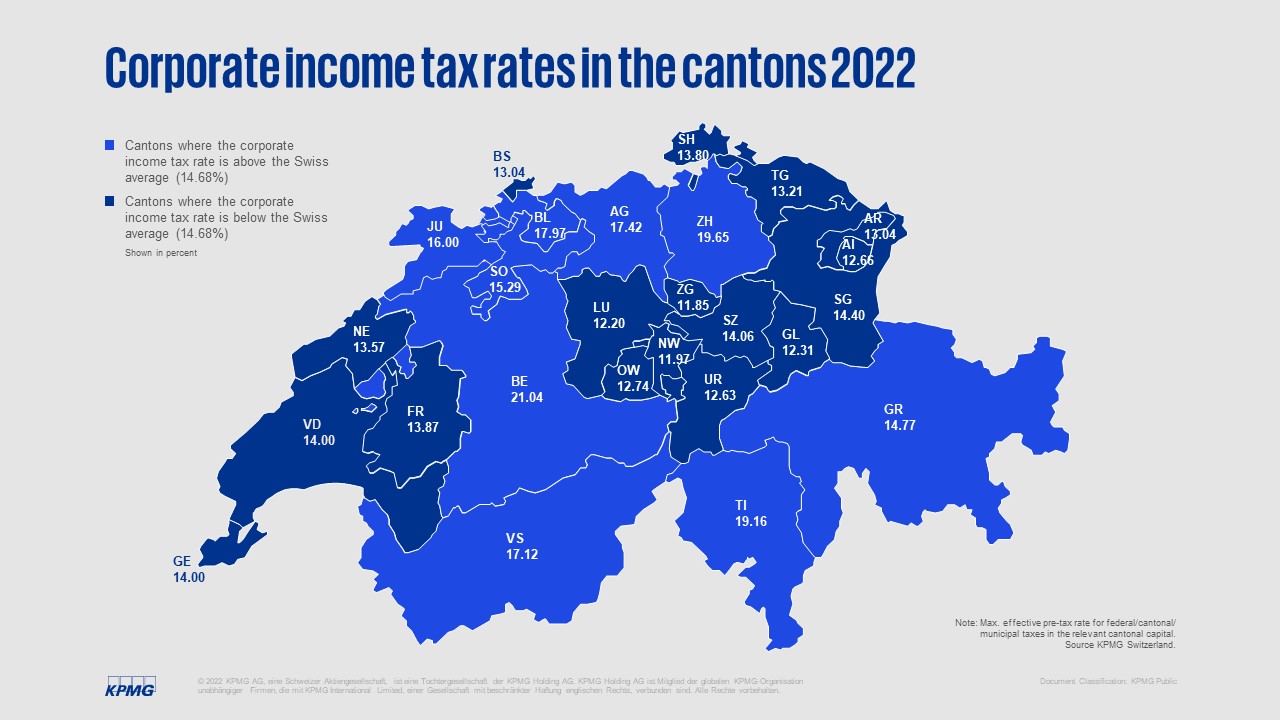

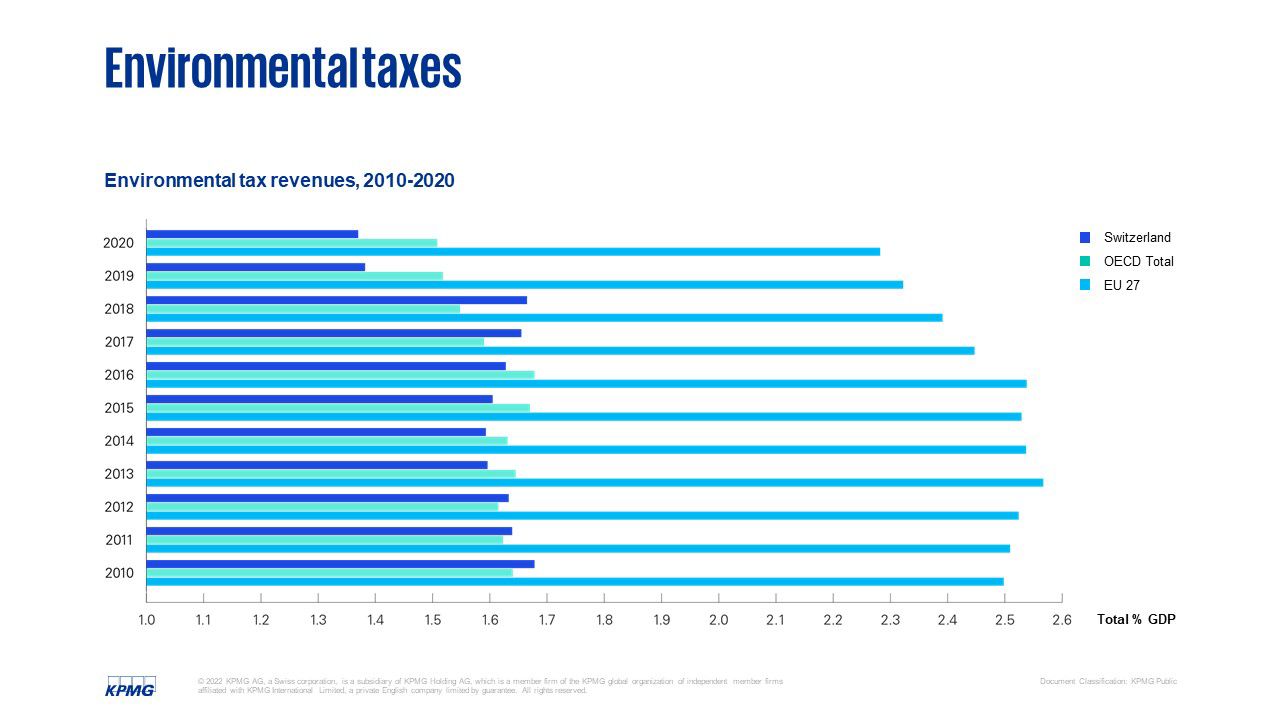

Kpmg Swiss Tax Report 2022 Kpmg Switzerland

Ceo Outlook Pulse Survey Insights For Tax Leaders Kpmg Global

Corporate Tax Consulting Kpmg Canada

World S Highest Effective Personal Tax Rates