wichita ks sales tax rate 2019

2022 Kansas state use tax. These insights are exclusive to Mint Salary and are based on 114 tax returns from TurboTax customers who.

Gov Laura Kelly Promises To Sign Bipartisan Bill Eliminating Kansas Sales Tax On Food By 2025 Kansas Reflector

Check out this handy publication for instructions on registering your business in Kansas.

. This is the total of state county and city sales tax rates. The gross receipts tax is much like a Value Added Tax only for businesses rather than individuals. Kansas is one of only 14 states to tax food and among only seven states that tax food at the full sales tax rate.

Jonathan Silvey - June 18 2020. No Local Income Tax. No City Sales Tax.

5 rows Kansas sales tax changes effective July 1 2019. The Washburn University School of Law and his Masters of Laws in Taxation. About our Cost of.

Wichita City Council is raising the sales tax from 75 to 95 - a 27 increase - in a community improvement district near the new baseball stadium and on the east bank of the. The minimum combined 2022 sales tax rate for Wichita Kansas is. Wichita KS 67213 Kellogg Tag Office 5620 E Kellogg Dr.

View City Fee Resolution PDF to see established fees and charges effective October. With local taxes the total. Neighboring Missouri taxes food at a rate of about 12 percent.

Four states impose gross receipt taxes Nevada Ohio Texas and Washington. The most common methods of assessment are the square foot basis and the fractional basis. The Kansas use tax is a special excise tax assessed on property purchased for use in Kansas in a.

At the same tax rate government revenues would increase at the same rate as prices incomes and property values. Compare sales tax rates by city and see which cities have the highest sales taxes across the United States. Iowa also 1 percent.

In 2019 it was 32721 based on the Sedgwick County Clerk. The average salary for a Retail Sales Associate in Wichita KS is 23500 per year. 3 Local Sales Tax Distribution of Revenue.

If you have any questions regarding sales tax exemption please contact Loretta Knott at LKnottwichitagov or by phone at 316-268-4636. On March 26 2019 the Kansas Senate confirmed Mark Burghart as the Secretary of Revenue. Below 100 means cheaper than the US average.

Download Avalara rate tables each month or find rates with the sales tax rate calculator. There may be additional sales tax based on the city of purchase or residence. No tax rate should ever go up.

Tax rate of 31 on the first 15000 of taxable income. The KS use tax only applies to certain purchases. SALES TAX WH TAX INCOME RESPONSIBLE PARTY TAX TYPE.

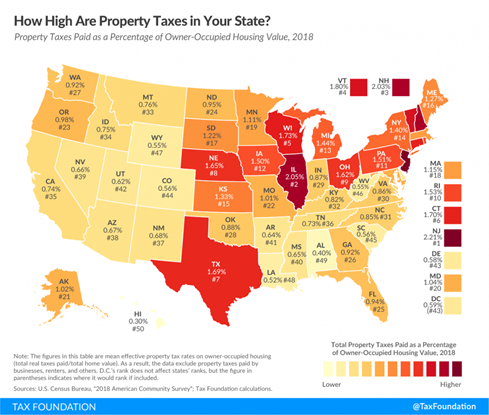

Above 100 means more expensive. Average Sales Tax With Local. The rate in Sedgwick County is 75 percent.

100 US Average. And local sales tax rate for Finney County outside the city limits of Garden City is 795. Taxes in Wichita Kansas are 138 more expensive than Rhome Texas.

1-22 2 KANSAS SALES TAX. New sales and use tax rates take effect. The County sales tax.

If the square foot basis is used each property owner will be responsible for a share of the project. Ad Choose Avalara sales tax rate tables by state or look up individual rates by address. Tax rate of 525 on taxable income between 15001 and 30000.

Tax rate of 57 on taxable income over. These are for taxes levied by the City of Wichita only. The Kansas sales tax rate is currently.

Kansas has state sales tax of 65. 31 rows The state sales tax rate in Kansas is 6500. Kansas asks that you file for your sales tax license 3-4 weeks before.

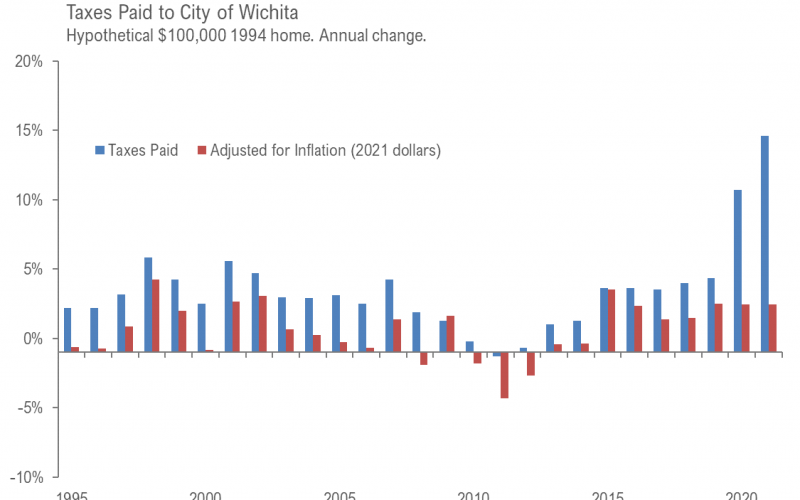

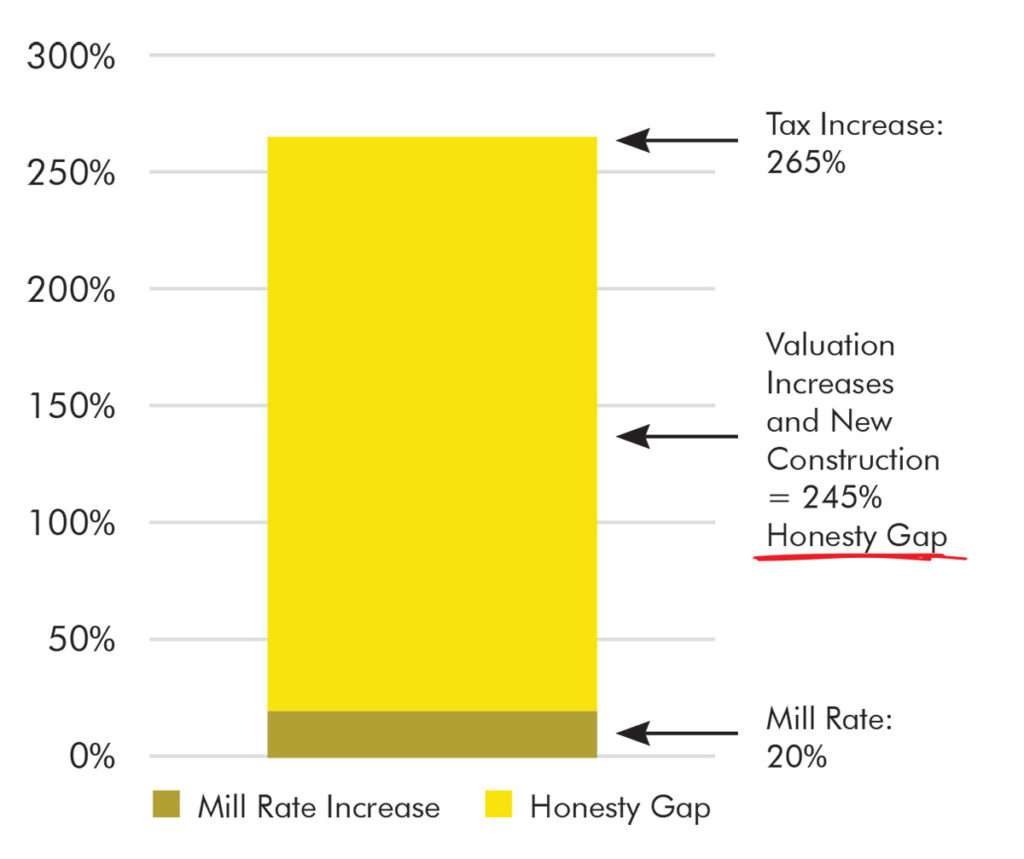

Thats an increase of 1431 mills or 457 percent since 1994. Des Moines voters approved a 1 percent.

Kansas Sales Tax Guide And Calculator 2022 Taxjar

Sales Tax Rates In Major Cities Tax Data Tax Foundation

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

File Sales Tax By County Webp Wikimedia Commons

Kansas Food Sales Tax Kc Healthy Kids

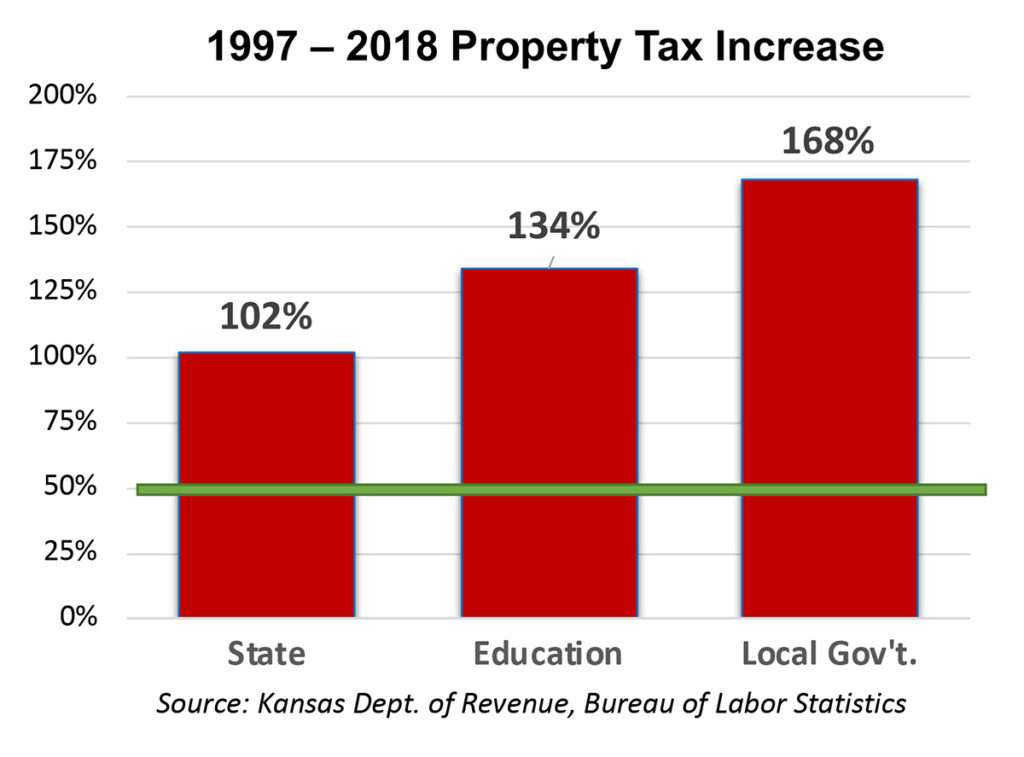

5 Things You Need To Know About Property Taxes In Kansas Kansas Policy Institute

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

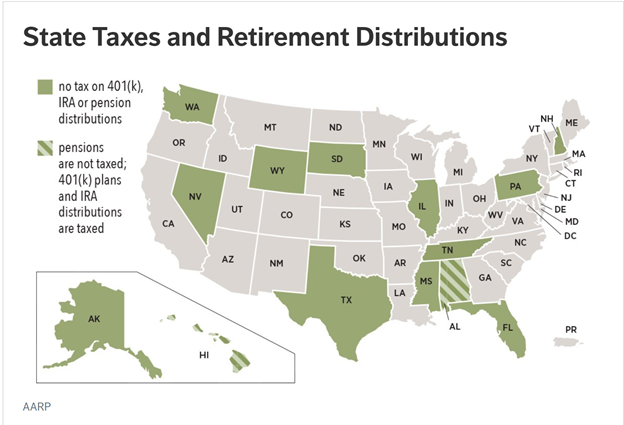

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute

Kansas Food Sales Tax Kc Healthy Kids

/cloudfront-us-east-1.images.arcpublishing.com/gray/MVMWZY7JTZC5HK6TDJ44RACC34.JPG)

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

Wichita Property Tax Rate Up Just A Little

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

5 Things You Need To Know About Property Taxes In Kansas Kansas Policy Institute

Sales Tax On Cars And Vehicles In Kansas